Linea‘s Bold Move: Aligning with Ethereum through Tokenomics

The Ethereum Layer-2 (L2) landscape is heating up, and Consensys-backed Linea is making a significant play to position itself as a prime destination for ETH capital. The network is gearing up for a token generation event, and the details reveal a strong commitment to aligning with the Ethereum mainnet, setting it apart from other L2 solutions. This move highlights not only the competition amongst L2s but the broader effort to deepen the Ethereum ecosystem’s value.

A User-Centric Airdrop and Burning Mechanisms

The upcoming Linea token launch is noteworthy, primarily due to its distribution strategy. A substantial 85% of the token supply is earmarked for the ecosystem, with a focus on rewarding users and builders. This approach demonstrates a commitment to fostering a vibrant community and incentivizing participation. The remaining 15% will be allocated to the Consensys treasury, locked up for five years. Furthermore, Linea will implement a mechanism to burn both ETH and its native token, LINEA. This strategic burning of tokens, with 20% of transaction fees going to ETH burn, suggests a deflationary model designed to boost long-term value for token holders and the Ethereum ecosystem, creating an economic advantage.

Staking, DeFi, and Attracting Capital

Linea is introducing a staking mechanism, anticipated to launch in October. This will allow users to earn rewards simply by bridging Ether (ETH) to Linea. This is a significant advantage as it makes ETH productive, allowing users to also participate in decentralized finance (DeFi) activities on the L2 network. Joseph Lubin, founder and CEO of Consensys, emphasizes Linea‘s aim to be the most compatible with Ethereum. He highlighted how harvested staking rewards will be distributed on Linea to DeFi protocols, enhancing yields for active liquidity providers. This creates a “flywheel” effect, attracting capital through sustainable incentives, ultimately aiming to attract more transaction volume.

Growing Market Share and the Ecosystem

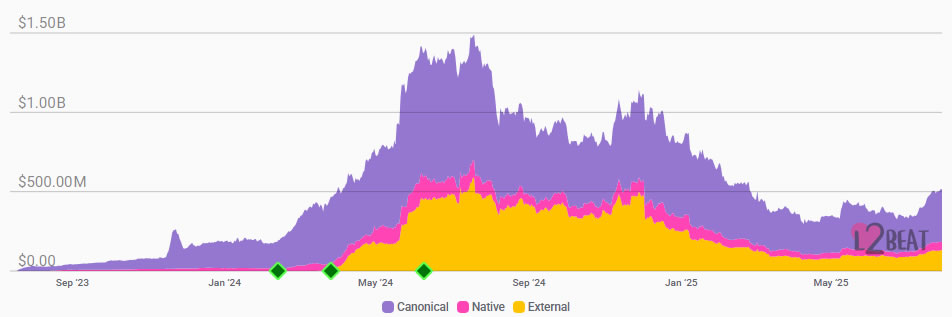

While Linea currently holds a relatively small share (1.23%) of the L2 market, the network aims to significantly expand its presence. This strategy involves building a robust infrastructure for ETH capital and attracting users and builders. The team believes that offering the best risk-adjusted returns for Ether liquidity providers will boost its market share. Leveraging Consensys’s ecosystem and the distribution of MetaMask will further enhance accessibility. This is especially important as the team emphasizes the strength of the Ethereum momentum and the growing adoption within the DeFi space.

Ethereum Alignment and Ecosystem Support

Linea‘s commitment to Ethereum goes beyond tokenomics. The project is actively involved in an Ethereum-aligned consortium, which will manage an Ethereum ecosystem fund. This consortium, including Eigen Labs and ENS Labs, among others, demonstrates a collaborative approach to supporting Ethereum‘s long-term development. This alignment with Ethereum is critical to the network’s strategy, which seeks to offer a seamless experience for users who want to remain firmly rooted within the Ethereum ecosystem.

“Linea‘s commitment to Ethereum couldn’t be clearer, and we think the platform’s unique alignment with Ethereum will make it an important part of its future,” said Joseph Chalom, co-CEO of SharpLink.