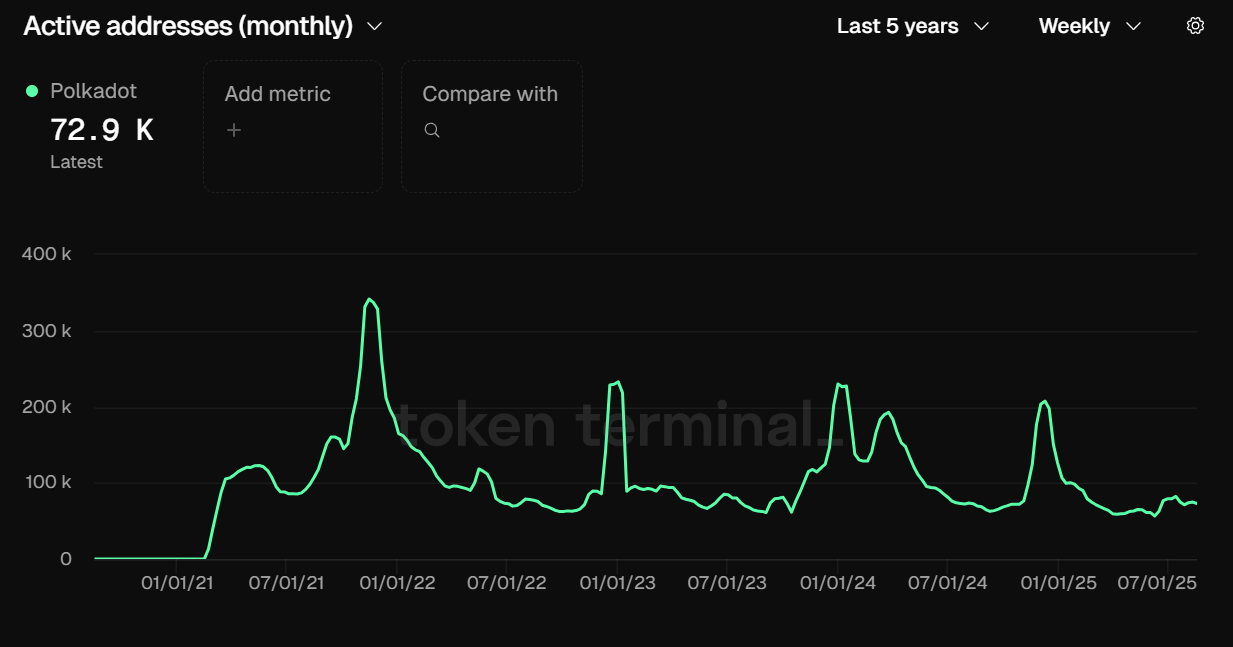

Polkadot‘s Institutional Ambitions: A New Division

Polkadot, a blockchain network renowned for its multichain architecture, is making a significant move to court Wall Street. The network has unveiled Polkadot Capital Group, a dedicated capital markets division, signaling its intent to bridge the gap between traditional finance (TradFi) and its blockchain ecosystem. This strategic initiative underscores Polkadot‘s ambition to attract institutional players, recognizing the growing interest in digital assets among established financial institutions.

Connecting TradFi with Polkadot Infrastructure

The primary mission of Polkadot Capital Group is to connect TradFi entities with Polkadot‘s infrastructure. This involves facilitating exploration of various opportunities, including asset management, banking solutions, venture capital investments, cryptocurrency exchanges, and over-the-counter (OTC) trading. The division will actively showcase practical use cases within the realm of decentralized finance (DeFi), staking mechanisms, and the rapidly expanding field of real-world asset (RWA) tokenization.

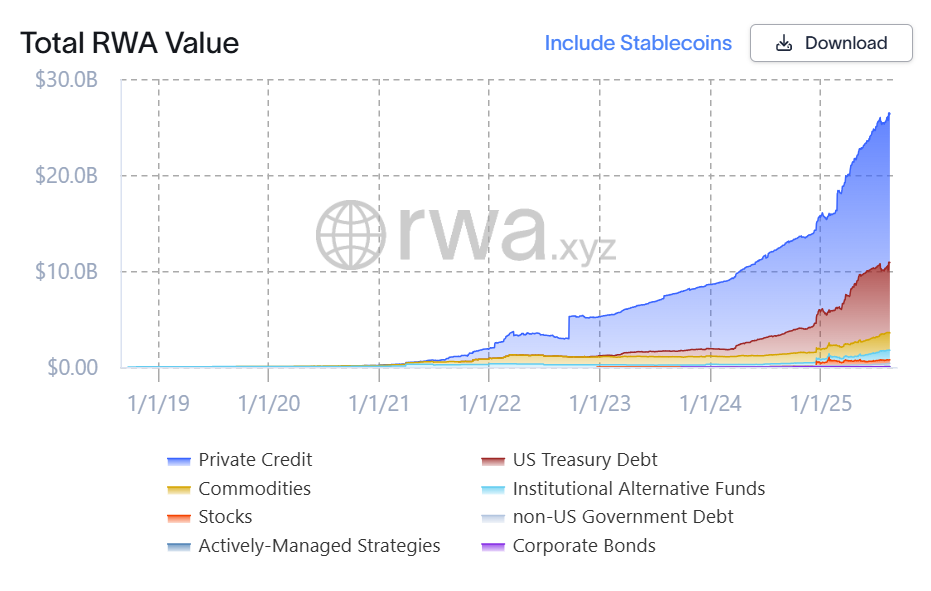

Focus on RWA and Institutional Demand

The timing of this initiative is crucial. It coincides with increasing institutional demand for digital assets and improved regulatory clarity, particularly in the United States. The rise of RWA tokenization, estimated at a market value of roughly $26.4 billion, has become a major catalyst for TradFi’s involvement in the blockchain space. Polkadot‘s move to capitalize on this trend positions it strategically within a rapidly evolving landscape.

Regulatory Tailwinds and Strategic Partnerships

While headquartered in the Cayman Islands, the division’s strategy also takes into account recent advancements in US regulations. This includes the passage of the GENIUS stablecoin act, along with ongoing discussions and developments concerning crypto market structure and measures related to central bank digital currencies (CBDCs). According to David Sedacca, lead of the Polkadot Capital Group, the team is already engaged in pursuing strategic partnerships with key players in the financial industry, including asset managers, brokers, and allocators.

The Competitive Landscape: A Push for Institutional Adoption

Polkadot’s latest maneuver reflects a broader trend within the crypto industry. Other blockchain firms are also realigning their strategies to cater to institutional demand, especially in areas like asset tokenization, bond issuance, and stablecoin settlement. Companies like Prometheum and Digital Asset are actively working to bring traditional securities on-chain, while Polygon is exploring similar avenues. This underscores a competitive race to capture institutional adoption and to redefine how financial assets are managed and transacted.

Implications for the Future

Polkadot’s push into the capital markets sector could significantly impact its ecosystem. Successful integration with TradFi could lead to greater liquidity, increased adoption, and enhanced legitimacy for the network. As institutions continue to explore blockchain technologies, Polkadot‘s proactive approach could solidify its position as a prominent player in the digital asset landscape. The future success of this initiative will be revealed as partnerships develop and the firm’s strategies play out in the financial sector.