Tron Inc.’s TRX Accumulation Spree

In a bold move that has captured the attention of the crypto community, Tron Inc., following its reverse merger, has substantially increased its holdings of TRX, the native token of the Tron blockchain. The company has added a significant $110 million in TRX to its treasury, effectively doubling its existing reserves and bringing the total holdings to over $220 million. This latest investment follows a previous commitment, further solidifying the company’s commitment to the TRX ecosystem.

Strategic Investments and Shareholder Confidence

The recent injection of capital comes directly from Bravemorning Limited, Tron Inc.’s largest shareholder. This entity exercised warrants to invest the additional $110 million, resulting in the acquisition of 312.5 million TRX tokens. This strategic maneuver underscores the confidence that key stakeholders place in Tron Inc.’s future. According to CEO Rich Miller, “With this additional $110 million investment from our largest shareholder, Tron Inc. has strengthened its position as the largest public holder of TRX tokens.” Bravemorning now holds a commanding 86.6% stake in the company, reflecting their substantial investment of $210 million to date.

The Reverse Merger and Rebranding

The genesis of this renewed confidence stems from the company’s strategic repositioning. Following the reverse merger with SRM Entertainment in June, the company secured $100 million in equity, including preferred shares and warrants valued at $210 million. This restructuring not only infused capital but also brought Tron founder Justin Sun on board as an advisor, injecting further expertise into the venture.

Stock Performance and Future Plans

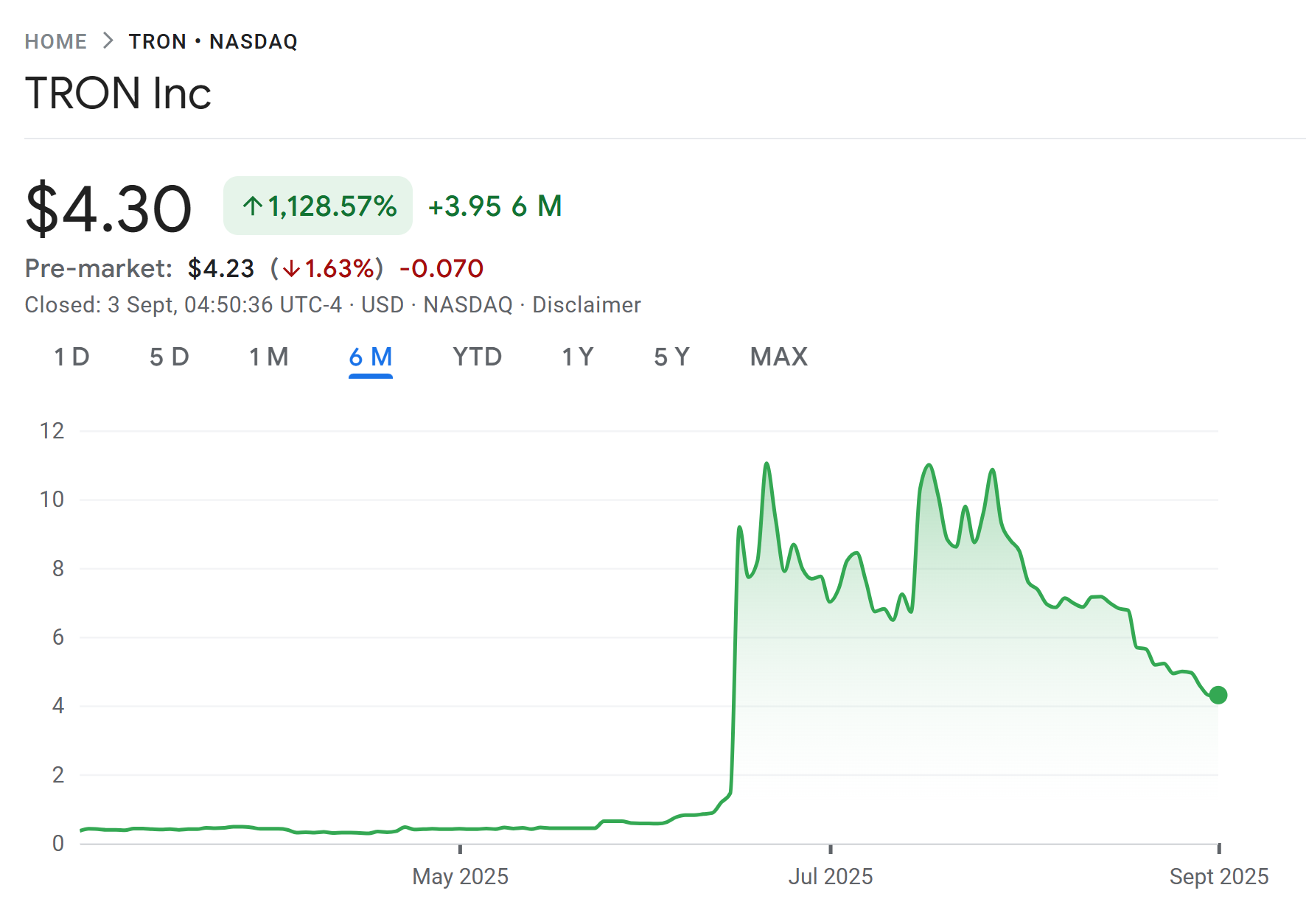

Since the rebranding and merger, Tron Inc.’s stock has experienced remarkable growth. Data indicates a surge of over 1,128% in the past six months. While the stock price has remained relatively stable recently, the overall trajectory is undeniably positive. The company’s forward-looking plans further solidify its position. In July, Tron Inc. filed with US regulators for a potential $1 billion capital raise through a mix of instruments. The funds are earmarked to expand the TRX reserve and bolster its Web3 business units. This multi-pronged strategy suggests ambitious growth targets, designed to strengthen the Tron ecosystem.

Risks and Rewards: Holding TRX as Reserve

The strategy of holding a significant amount of its own token as a reserve asset has drawn some scrutiny. Jamie Elkaleh, marketing chief at Bitget Wallet, commented on the potential risks, suggesting that a decline in confidence could lead to a devaluation of TRX, thereby impacting the perceived value of Tron Inc. However, this is a double-edged sword. A successful venture, driving demand and utility of TRX, could lead to significant value appreciation, benefiting both the company and its stakeholders.

Looking Ahead

Tron Inc.’s substantial investment in TRX represents a strong vote of confidence in its underlying technology and the long-term prospects of the Tron blockchain. The moves signal not only a strategic alignment with TRX but also a belief in the broader adoption and development of Web3 technologies. Investors and enthusiasts will be keenly watching the company’s progress as it continues its expansion efforts.